Contributed by Deniece Peterson, Senior Director of Federal Market Analysis, and Paul Irby, Manager of Research, Deltek

Companies that offer services to the government know that the GovCon environment can be a tricky one to forecast, especially at a time where there are questions about future federal budgets and the potential for continued (or reduced) inflation. At the same time, they may be looking to optimize their business development strategies and safeguard their business plans in an uncertain environment.

To combat this uncertainty, the Deltek research team providing government intelligence for the GovWin IQ platform has sorted through the data to come to an understanding of what is expected to make the greatest impact on the U.S. federal and SLED (state, local and education) government contracting markets in 2023. Some of the themes that are projected to be impactful on all markets include expected budget increases, ongoing inflation and supply chain questions, workforce issues, and an increased focus on ESG (environmental, social, and governance) priorities.

Below are summaries of the top-level trends that GovWin’s research team has identified at the U.S. federal and SLED levels of government for businesses to watch in 2023.

U.S. Federal Government Contracting Trends in 2023

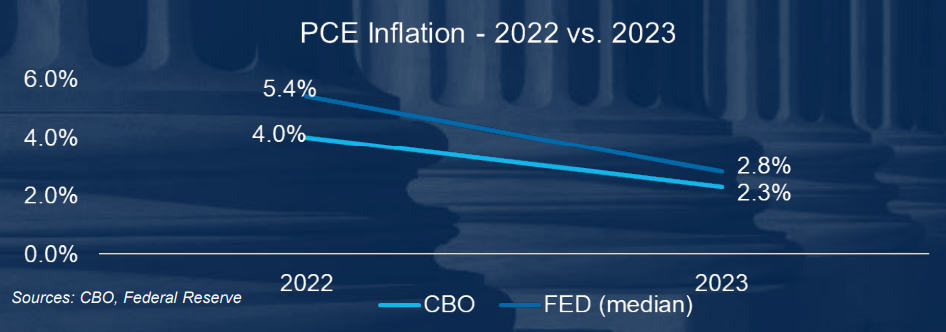

Although inflation rates are expected to decline at least somewhat, government contractors across a wide range of industries are still experiencing challenges or recovering from a period of heavy inflation, and this topic is front of mind in federal contracting. The Federal Reserve and the Congressional Budget Office (CBO) estimate that PCE inflation will decline in 2023 (as shown in the chart below) due to reduced supply disruptions, lower energy costs, slower growth in the prices of goods, and monetary policy.

The questions around inflation, coupled with the return of federal budget uncertainty due to changes in Congress and the debt ceiling approaching, will be issues federal government vendors must pay close attention to. While inflation rates are expected to decline over the course of 2023, contractors are still experiencing challenges or recovering from the difficult environment in 2022.

Global supply chain issues, more GWAC and IDIQ contract vehicles, workforce issues, cybersecurity compliance and ESG initiatives are other market trends that GovWin research has identified for federal government vendors to watch.

U.S. State and Local Government Contracting Trends in 2023

While the crisis mentality of buying emergency items in 2020 is generally in the past, record-high inflation driven by continued supply side constraints has affected state and local contracting in various ways—particularly for basic commodities. Despite these constraints and the negative tilt of the economy, the SLED market has shown resiliency and confidence due to rapid recovery in several sectors and support of stimulus funding.

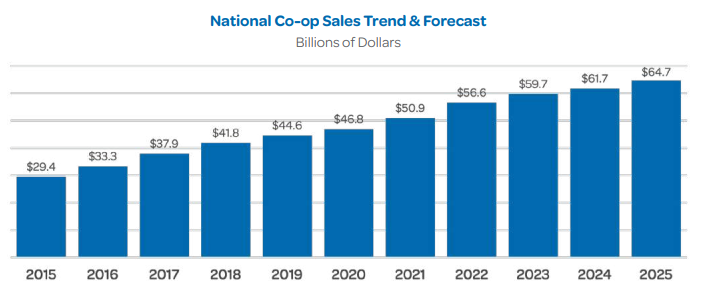

One area of the SLED government sales market that remains bright is in cooperative purchasing. Defined as when multiple buyers are allowed to purchase from the same competitively sourced long-term contract, cooperative purchasing has helped SLED governments to solve problems, increase efficiency, and add value. As the chart below shows, cooperative purchases have increased every year since 2015—even through the pandemic—and are poised to continue this trend in the next several years.

Other factors that GovWin research has identified to watch for in the SLED segment of the public sector are constraints on talent and workforce (similar to those issues also occurring in the federal sector) and an increased focus on climate/environment and diversity that should continue to be a primary focus for governments in 2023 and beyond.

Share Your Expertise With SAME

SAME invites A/E/C and related industry professionals, academics, uniformed servicemembers, and government leaders to submit news articles sharing their insights and thought leadership on timely topics. Read our Writer’s Guidelines and submit your own article for consideration at the links below.

-

- Business Development, Construction COI, Education and Training, Guest Posts, Professional Development, SAME National News, Small Business COI, Sponsored Content

Guest Post: Top Federal and SLED Government Contracting Trends for 2024

-

- Business Development, Construction COI, Education and Training, Guest Posts, SAME National News, Small Business COI

Guest Post: The Top Opportunities in Federal A/E/C Contracting for FY2024

-

- Guest Posts, Networking, Professional Development, SAME National News, Strengthening Industry-Government Engagement

Guest Post: Government Project Management and the Value of SBC