Top State, Local, Education and Federal GovCon Trends in 2024

Contributed by Deniece Peterson, Senior Director of Federal Market Analysis, and Brent Mital, Senior Research Analyst, Deltek

With the 2023 calendar year behind us, and both federal and state, local and education (SLED) government entities already in full swing with their plans for 2024, it’s a good time to look back at the previous year, examine the topics most relevant in contracting for the year ahead, and start to build a strategy to succeed over the next 12 months.

In this article, we will review the top federal government contracting and SLED government contracting trends that we expect to have the greatest impact this year. These trends are curated by seasoned analysts leveraging data from Deltek’s GovWin IQ platform of government market intelligence. If you’re trying to ensure that your federal or SLED government contracting business is best prepared for what’s to come this year, take note of the topics below and consider if you have the information and tools that you need to succeed.

2024 Federal Government Contracting Trends

The federal contracting environment is lucrative but challenging. A wide variety of factors, such as continuing resolutions, executive orders, rule changes, inflation, the war for talent, geopolitical instability, increasing adoption of artificial intelligence, and other issues, will create a complex landscape for federal contractors in 2024.

Keep an eye on these three federal trends:

- Inflation and Interest Rates. Government contractors continue to navigate through rising costs in goods, energy and talent. The Federal Reserve anticipates inflation to decline in 2024, with cautious optimism regarding overall economic health. But small businesses are still concerned about the economic environment–according to a Goldman Sachs survey, 78 percent of small business owners are concerned about access to capital, while 29 percent say they can’t afford to take out a loan given current interest rates.

- Focus on Small Businesses. The Biden Administration continues to pressure agencies to increase small business contracting opportunities and lower barriers to entry. Although progress was made in 2023, agencies will continue to drive initiatives to increase small, disadvantaged business utilization rates, develop tools to attract and retain small businesses, expand the resources available to small businesses to compete, and leverage agile and innovative small businesses to speed progress in the adoption of emerging technologies.

- Supply Chain Issues. Global supply chain issues, initiated by the COVID-19 pandemic and sustained by the Ukraine/Russia war and other world events, have made ensuring the resilience and trustworthiness of the U.S. supply chain a top federal priority. Related policy drivers include inherent security of supply chain elements, particularly for cybersecurity products, but also for software and hardware, and economic concerns to bolster the financial health and stability of U.S. producers and suppliers.

2024 SLED Government Contracting Trends

The SLED market is complex and varied–trends in one sector or industry segment may or may not apply to others. Generally speaking, our research shows that the market is well-positioned for potential growth in 2024.

These are three SLED trends worth watching:

- Potential for Recession. The question of whether we may tip into a recession will no doubt linger well into 2024. Economists are divided because the current set of economic conditions are unprecedented and therefore very difficult to predict, but economists generally think if it happens it would probably be mild and low-impact, which would in turn be a positive outcome for the SLED purchasing market.

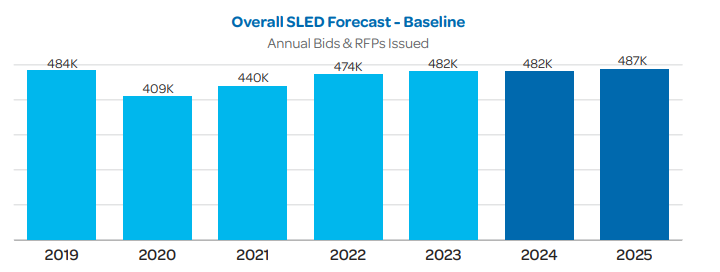

- Stability in Bids and RFPs. The SLED contracting market has been steadily rebounding and improving since 2020, adding more than 70,000 bids to reach 482,000 in 2023, just below 2019 levels. We expect stability over the next two years with the market forming a multi-year plateau of volume. 2024 will be almost the same as 2023, but 2025 will show just enough growth to surpass 2019 for the first time since the onset of the 2020 pandemic.

- Growth in Cooperative Purchasing. The outlook for cooperative purchasing continues to be robust with growth continuing at a faster pace than the broader market of SLED purchasing. This is driven by strong demand by public sector buyers for convenience and efficiency. GovWin’s own analysis of 13 leading national coop organizations supports a current market size of around $64 billion for 2023 that should reach $72 billion by 2026.

The above combination of opportunities, requirements and challenges drive several broad themes that will impact contractors’ operational costs, business development strategies and competitive positioning for the current year. You can find more information on the 2024 federal trends to watch in this report, and gain access to a deeper dive into the 2024 SLED Government Contracting Forecast here.

Share Your Expertise With SAME

SAME invites A/E/C and related industry professionals, academics, uniformed servicemembers, and government leaders to submit news articles sharing their insights and thought leadership on timely topics. Read our Writer’s Guidelines and submit your own article for consideration at the links below.

-

Guest Post: Top Federal and SLED Government Contracting Trends for 2024

Federal and state, local and education government entities are already in full swing with their plans for 2024, Deltek examines the topics and trends most relevant in contracting for these markets for the year ahead. -

Guest Post: The Top Opportunities in Federal A/E/C Contracting for FY2024

Winning state and local government contracts can be competitive and challenging. Deltek’s research team dives into the current market conditions and trends to share tips on how to win these types of contracts. -

Guest Post: Government Project Management and the Value of SBC

Guest contributor Dennis Milsten discusses the value of the SAME Federal Small Business Conference for government project managers and contracting officers.