Contributed by Deniece Peterson, Senior Director of Federal Market Analysis, GovWin from Deltek

Each year, Deltek’s Federal Market Analysis (FMA) team supporting the GovWin IQ platform of government market intelligence reviews the federal budget request upon its release. This year, our team combed through the available budget details for our Federal A/E/C Budget Outlook report, and found several interesting details to be noteworthy for the largest departments and agencies.

Below is a brief review of the top-level trends that GovWin’s research team found from the federal budget release, specifically areas that are most relevant to companies who provide A/E/C services to the federal government.

U.S. Federal Government Contracting Trends in 2023

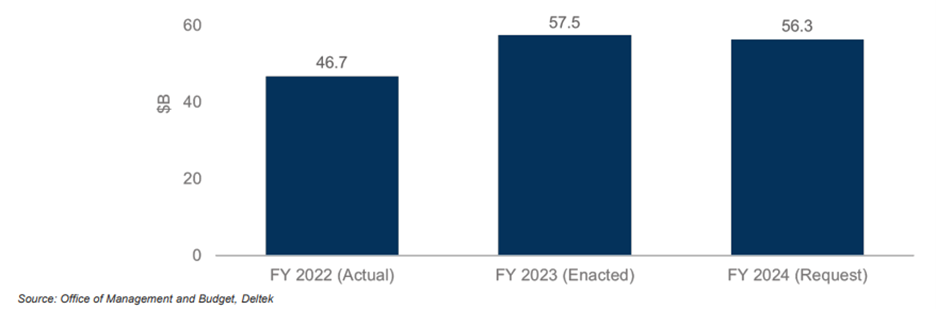

In total, the President is requesting $56.3 billion for A/E/C-related activities for FY2024, representing a 2.1 percent decrease from FY2023 (as shown in the chart below). The administration proposes increases for many important infrastructure programs, including those previously boosted by the Infrastructure and Investment Jobs Act.

The slight decrease held true across the breadth of A/E/C services. The majority of federal A/E/C expenditures (approximately 78 percent) are related to construction services, which dipped from $44.7 billion in FY2023 down to $43.7 billion in FY2024. The smaller architecture and engineering services category dipped from $11.3 billion to $11.1 billion over the same range of time.

In total, the President is requesting $56.3 billion for A/E/C-related activities for FY2024, representing a 2.1 percent decrease from FY2023

Breaking this down by department provides a little more nuance. The top department by far in spending on A/E/C is the Department of Defense (DOD), which accounts for about 47 percent of the total budget request. DOD spending drops from $30.7 billion in FY2023 to $26.3 billion in the FY2024 budget request. However, this decline sits primarily in Army, which requested a $2.5 billion drop from FY2023 that significantly impacts the overall A/E/C budget size. And the second highest-spending department, the Department of Veterans Affairs, is projected to increase from $6.2 billion in FY2023 up to $9.5 billion in FY2024. So while overall federal A/E/C spending may decline slightly, this drop will not be found evenly across departments.

Three Issues to Watch

In our full architecture, engineering, and construction budget outlook report we examined each of the top market segments and the top 10 federal departments in more detail. From that data, we found three issues of note that are likely to impact A/E/C contractors.

- The Infrastructure and Investment Jobs Act (IIJA). The FY2024 augments IIJA funding that agencies are still distributing. Given the additional funding, agencies may face bottlenecks as they work to spend additional funding within a fiscal year truncated by appropriation delays.

- The Made in America Agenda. The Biden Administration increased the domestic content threshold to 60 percent in FY2023, with an increase to 65 percent planned for FY2024. This will have an impact on construction contractors’ supply chain strategies and costs.

- Climate Resilience. The Biden Administration continues to prioritize facilities’ climate resilience, which will push agencies to invest in targeted facilities upgrades and modernization. Federal contractors should also be prepared to address climate impact provisions emerging within RFPs.

Share Your Expertise With SAME

SAME invites A/E/C and related industry professionals, academics, uniformed servicemembers, and government leaders to submit news articles sharing their insights and thought leadership on timely topics. Read our Writer’s Guidelines and submit your own article for consideration at the links below.

-

Guest Post: Four Federal A/E/C Budget Takeaways for Government Contractors in FY2025

Deltek’s Federal Market Analysis team analyzes the federal budget request for GovWin IQ. Deltek’s team reviews the budget details for our Federal A/E/C Budget Outlook Report, and found some interesting details worth noting for the biggest departments and agencies. -

Guest Post: Planning Through Design at JETC 2024

Join the discussions at the IGE Roundtables a JETC 2024 as they continue the discussion from the Europe Tri-Services Conference on planning through design for delivery solutions in Europe. -

Guest Post: Engage With the “Silent Function” at JETC 2024

SAME’s Geospatial Working Group will offer an expanded slate of programming and opportunities for attendees looking to dive into the diverse discipline of geospatial engineering at JETC 2024.